19+ Cash out refi rates

You can compare the Loan Estimate from multiple lenders to. Home buyers who have a strong down payment are typically offered lower interest rates.

A 15 Year Mortgage Is Probably Best But It Has One Big Disadvantage

A cash-out refi comes with advantages and disadvantages.

. Refinancing is the replacement of an existing debt obligation with another debt obligation under a different term and interest rate. The lower your interest rate on your cash-out refi. Mortgage interest rates are typically much lower than credit card rates so using a cash-out refinance.

A remortgage known as refinancing in the United States is the process of paying off one mortgage with the proceeds from a new mortgage using the same property as security. You pay off your current mortgage and replace it with a new mortgage that has a 3 interest rate and principal balance of 225000. Compare current cash-out refinance rates learn more.

Home Loan Interest Rates. However Pennymac provides you the flexibility to set the loan term on a cash-out loan which can help offset the total amount paid over the life of the cash. The terms and conditions of refinancing may vary widely by country province or state based on several economic factors such as inherent risk projected risk political stability of a nation currency stability banking regulations borrowers credit.

Youve paid down the mortgage by 25000 so your current principal balance is 225000. Homeowners who put less than 20 down on a conventional loan also have to pay for property mortgage insurance until the loan balance falls below 80 of the homes valueThis insurance is rolled into the cost of the monthly home loan. You see lenders advertising 3 mortgage refinances rates.

Home buyers who have a strong down payment are typically offered lower interest rates. The term is mainly used commercially in the United Kingdom though what it describes is not unique to any one countryOften the purpose of switching is to secure a more favorable interest rate from a. Pros and cons of cash-out refinancing.

For example if youre five years into your current 30 year loan and take out a cash-out loan with a 30 year term then you will most likely pay more over the life of the cash-out loan. Shop and apply for refinance loans. We offer competitive mortgage rates.

If you refinance these loans you will no longer qualify for this relief or other federally-held loan benefits. If you request it each lender can provide you with a Loan Estimate which includes the terms of the loan projected payments if you were to take out the loan and a summary of loan costs and fees. COVID-19 in Washington.

Today the value of that home has increased to 300000. Heres what you need to know about home loan interest rates--especially if you want to build a home. How does the cash rate affect deposits.

We currently offer fixed 30 year loan fixed 15 year loan 71 arm loans 51 arm loans and 11 arms. Contact multiple lenders and inquire about rates fees and lender qualification criteria. Generally speaking the movements of the cash rate up or down will have a similar effect on the interest rates on savings accounts and term depositsIf the cash rate rises then banks might raise the interest rates on deposits which might in turn encourage people to deposit their money in savings with a view to earning interest.

We offer free pre-approvals on home loans. It can make your monthly payments more expensive but home improvements boost your equity value even more. You Deserve A Better Mortgage Experience Experience the Handshake difference.

Get a mortgage Quote Our Client Reviews Google Rating 49Based on 557 reviews Handshake Home Loans Inc. September 9 2022 - If you want to apply for an FHA mortgage knowing a few facts about how home loan interest rates work can really help you during the planning stages. You will receive unmatched service a fast closing and a great rate.

Federally-held student loans have a suspension of payments and a temporary interest rate of 0 until 123122. If you need money for renovations a cash-out refi offers relatively cheap capital. 49Jodie Traslavina1515 29 Jun 22Nick and Tyler were amazing they helped me through the whole.

Homeowners who put less than 20 down on a conventional loan also have to pay for property mortgage insurance until the loan balance falls below 80 of the homes valueThis insurance is rolled into the cost of the monthly home loan.

Corey Vandenberg Mortgage Loan Officer Lake State Mortgage Linkedin

Bonita Springs Estero July 2022 I Mattbrownrealestate Inaples Fl

The Aaron Duez Team Home Facebook

The Perfect Financial Advisor White Coat Investor

A 15 Year Mortgage Is Probably Best But It Has One Big Disadvantage

Benefits Of Having A Good Credit Score

2

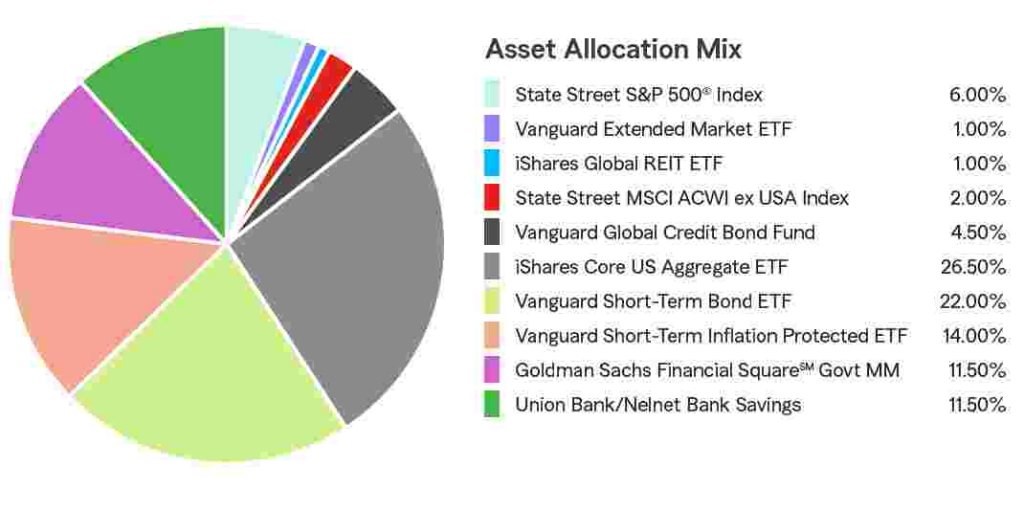

State Farm 529 Savings Plan Age Based 19 Plus Portfolio State Farm

10 Home Mortgage Templates In Pdf Doc Xls Free Premium Templates

Reviews About Quicken Loans

A 15 Year Mortgage Is Probably Best But It Has One Big Disadvantage

Why Exponential Growth Is So Scary For The Covid 19 Coronavirus

How To Choose 529 Plans For Your Child S Education Moneygeek Com

19 Massive Millennial Spending Statistics Spendmenot

Macro Island May 2022 Report I Matt Brown Real Estate I Naples Fl

Why Exponential Growth Is So Scary For The Covid 19 Coronavirus

19 Credit Score Statistics For An Awesome Fico In 2021